Import Bank Statements into Cash Book

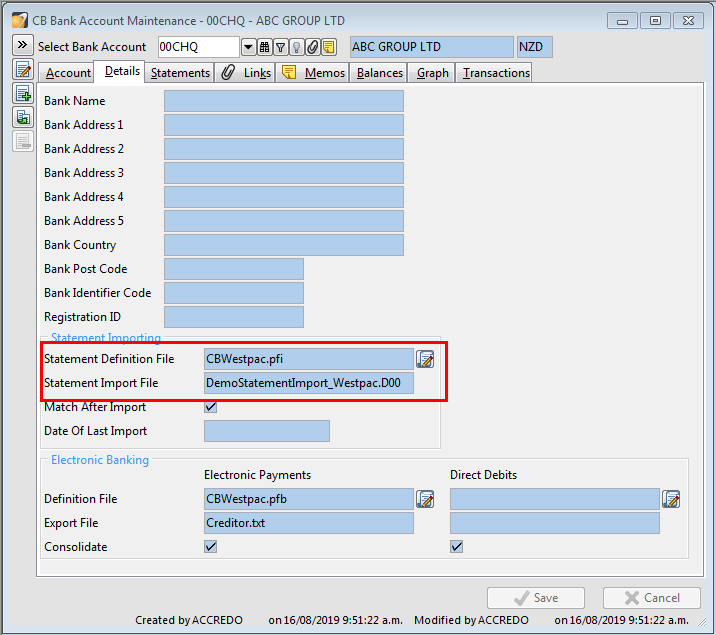

Set up Import files

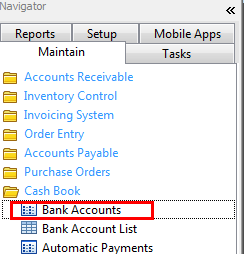

Maintain\Cash Book\Bank Accounts

Use appropriate Statement definition files and set the csv file path in the Statement Importing area

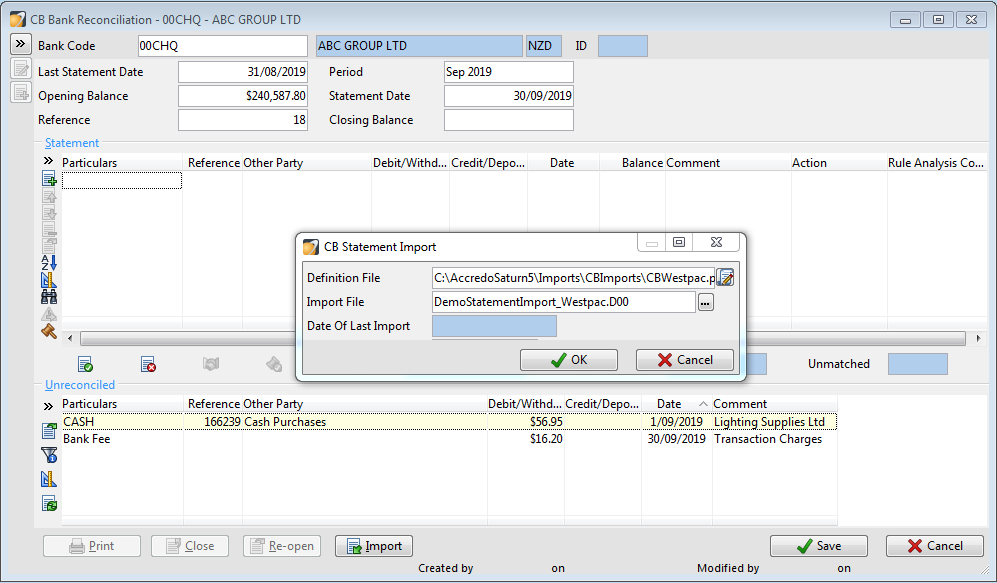

Import Bank Statements

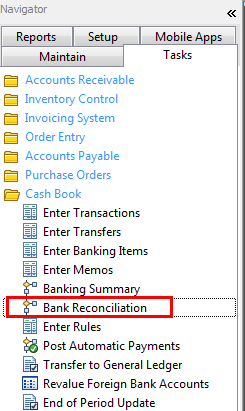

Tasks\Cash Book\Bank Reconciliation

Insert a new bank statement, then click the “import” button , choose the Import file which is the bank statement csv file just being exported.

After clicking the Import button, there a few results in the middle Statement area,

Dark grey lines: Reconciled. One clear matching unreconciled transaction has been matched.

White lines: Ambiguous? Two or more unreconciled transactions match to the statement line or two or more statement lines match to one transaction.

Manually match unreconciled transaction with the line by choosing the unreconciled transaction and the line then clicks “Match”.

White lines: Amount? One or more unreconciled transactions match on amount only.

Manually match unreconciled transaction with the line by choosing the unreconciled transaction and the line then clicks “Match”.

White lines: Withdrawal, Deposit, Transfer, Receipt or Payment. A rule has been matched to the line. The Rule Type is displayed.

Apply the Rules. Select the line then click Apply the Rules.

White lines: Rules? Conflicting rules have been found.

Edit rules to match the line. Choose the line, then click Add/Edit Rule.

You will see all the Conflicting rules on this line. Update the rules to make sure only one rule can be applied to the line then save. The line action now becomes the rule type. Then click Apply the Rules.

White lines: Unmatched. No transactions match and no rules apply.

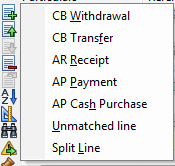

Create transactions to reconcile the line. Select the unmatched line, insert a transaction type to create a transaction in Accredo.

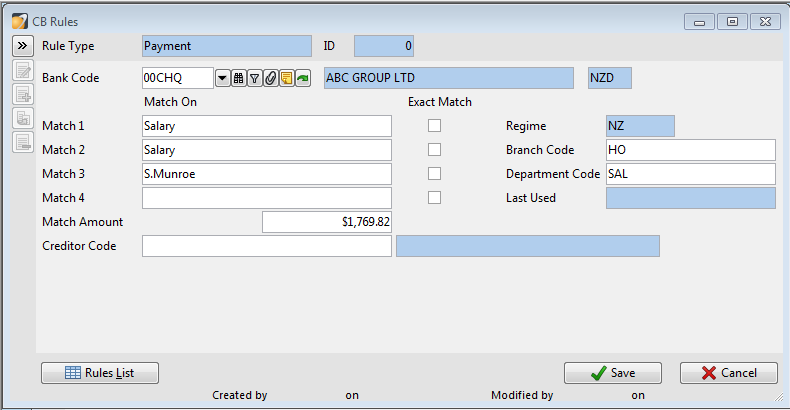

Create Rules

Add\Edit Rule

Choose rule type, words to be matched, customer/creditors other details to be coded for the transactions.

Apply rules

Apply Rules

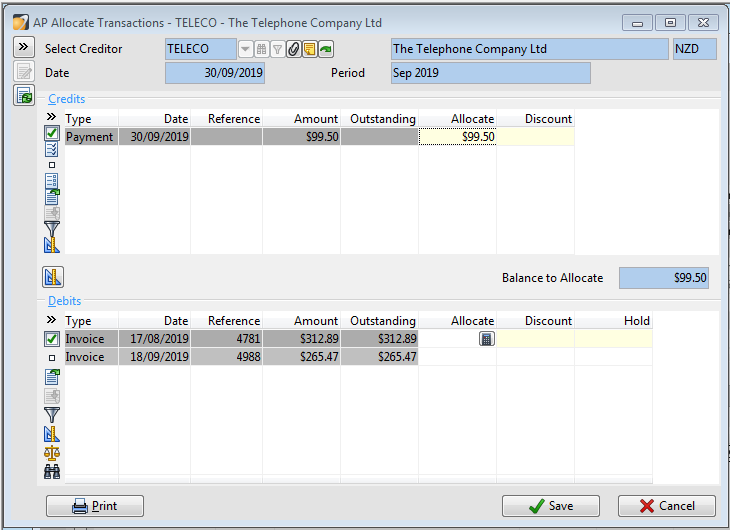

When applies the rule, it will create the transaction accordingly in the relevant modules and then match then in the bank reconciliation. For example, the rule of AR Receipt will create an Account Receivable transaction and Cash Book bank reconciliation. You will be asked for allocation.

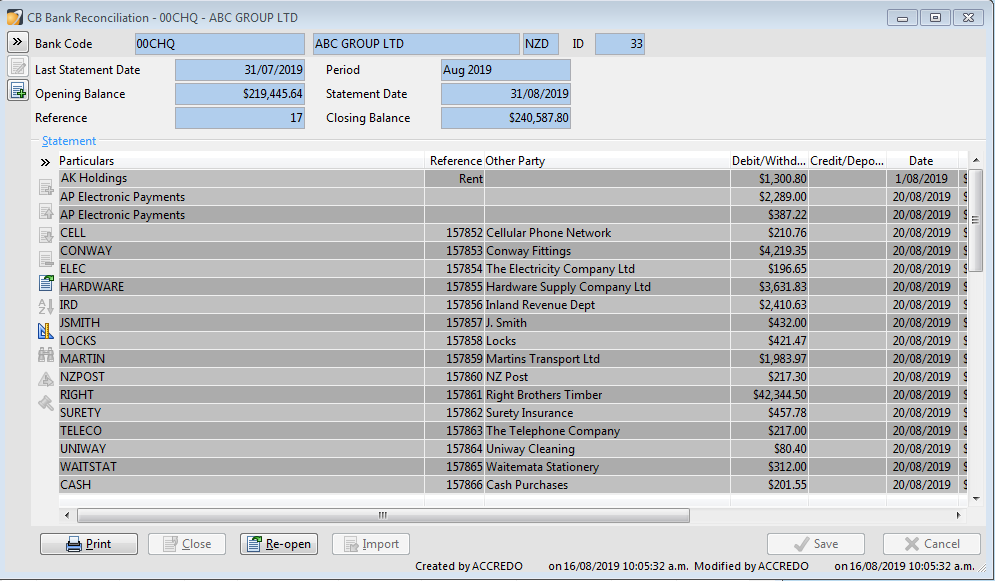

Close bank reconciliation

Before save and Close the bank reconciliation,

Double Check the Last Statement date, Statement Date, Opening and Closing Balance need to be the same as the real bank statement.

All the lines in the Statement area are Reconciled.

Nothing to be Reconciled, no rules to Apply, nothing is unmatched.