Analysis Codes and Dissections

General Information on Analysis Codes

Analysis dissections are used to analyse the financial information component of transactions entered in Accredo. For example, a creditor invoice is analysed into expense dissections, with each dissection line relating to an expense code. Analysis dissection codes are accessible via the Maintain tab.

Anylasis Codes allow you to Map the Expense/Invoice to GL Codes. They are an alpha friendly code for GL accounts. They are used to flow the data to the GL.

Anylasis Codes allow you to default GST Code and in the case of Cash Book allow them to be filtered.

The Cash Book means, some codes can be filtered to only appear on Deposits or Withdraws or both.

An example of a Cashbook Anlysis code is BFee(Bank Fees) It is easier to remember BFEE instead of 1800.000.

Account Receivable’s Analysis Code is called Sales Group.

Account Payable’s Analysis Code is called Expenses Code.

Cash Book’s Analysis Code is called Analysis Code.

For each analysis dissection, a General Ledger account is to be specified. These specifications will determine the treatment and breakdown of transactions posted to the General Ledger.

The following are the analysis dissection codes:

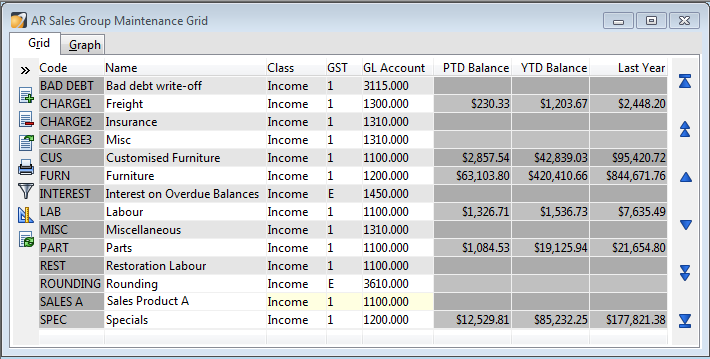

Accounts Receivable’s Analysis Codes

These are called Sales Groups in the Accounts Receivable module.

This is located under Maintain > Accounts Receivable > Sales Group Grid

Code - Is the friendly code used in AR and IN.

Description - Is the Name.

Class - You can divide the Sales Groups into classes for reporting

GST Code - Default GST Code, when this Analysis code is used.

GL Account - Where this Analysis code is mapped into the GL.

For example, Sales A would have an income class, GST 1, and would be related to a revenue account 1100.000 in the General Ledger

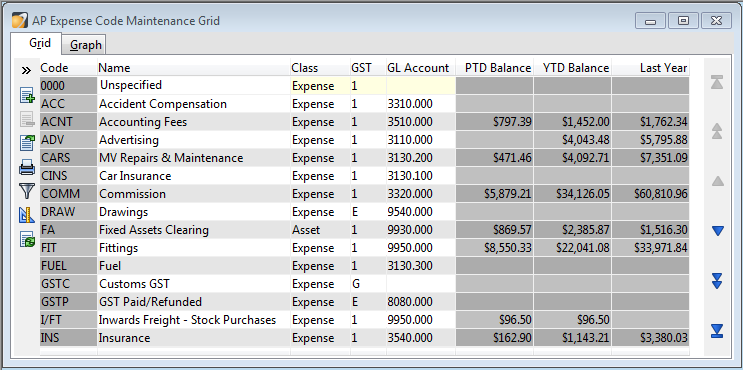

Accounts Payable’s Analysis Codes

These are called Expense Codes in the Accounts Payable module.

Maintain > Accounts Payable > Expense Codes Grid

Code - Is the friendly code used in AP and PO

Description - Is the Name.

Class - You can divide the Expense Codes into classes for reporting

GST Code - Default GST Code, when this Analysis code is used.

GL Account - Where this Analysis code is mapped into the GL.

For example, ACC would have an expense class, GST 1, and would be related to the ACC expense account 3310.000 in the General Ledger

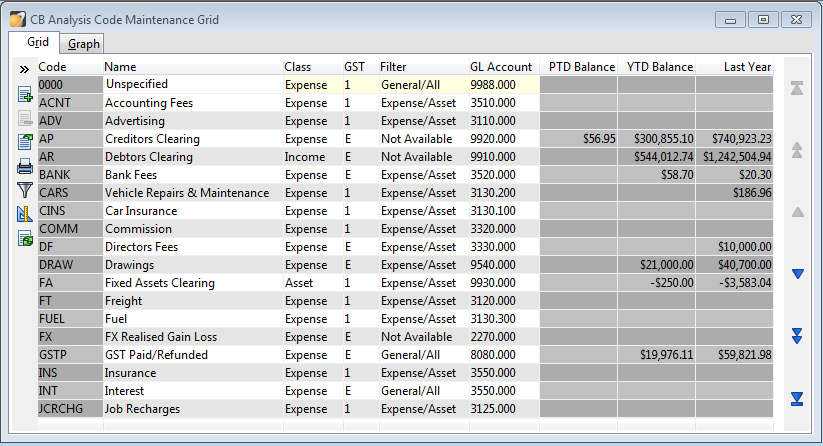

Cash Book’s Analysis Codes

These are called Analysis Codes in the Cash Book module.

Maintain > Cash Book > Analysis Codes Grid

Code - This is the friendly code used in CB.

Description - Is the Name.

Class - You can divide the Analysis Codes into classes for reporting

GST Code - Default GST Code, when this Analysis code is used.

GL Account - Where this Analysis code is mapped into the GL.

Analysis Filters: For Cashbook it is important to note the Filter that is applied to the code. If an Analysis Code has a filter of Expense/Asset only Cheques will be able to be drawn from this code. If the account has a filter of Income/Liability only Deposit transactions can be entered to this. If you wish an account to be available for both you can apply a filter of General/All.

To edit the filter select the code you wish to edit and click in the field underneath the grid heading of filter. Use the drop down arrow to select from the list of options.

For example, ADV would have an expense class, GST 1, and would be related to the advertising expense account 3110.000 in the 'General Ledger'.

It has a filter of ‘Expenses/Asset’ Which means it will only be available on a Cashbook - Withdrawal.