Journals and GST adjustments

In this lesson you will learn about using the Accredo system.

After completing this lesson you will be able to:

• Understand the different types of Journals

• Create and Post a General ledger Journal

• Enter a GST Adjustment Journal (CB journal method)

• Print Financial Reports

• Perform End of Period Updates.

Understand the Different Types of Journals

Module Batches

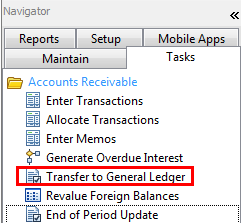

Module Batches are created when transactions are transferred to the General Ledger via the Tasks Menu. Modules include:

Accounts Receivable module, Inventory Control module, Accounts Payable module, Cash Book module, Fixed Assets module

To transfer transactions to the general ledger, go to Tasks and click on Transfer to General Ledger in each module

Confirm the period to transfer up to and click OK

General Journals

General Journals are used for General Ledger adjustments.

General Ledger Journals Don't have an affect on Sub module Batch's

To create a new batch

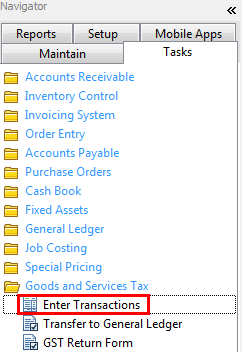

Go to Tasks\General Ledger\Enter Transactions

Click on the Insert button (Alt F4)

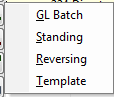

Choose the type of journal you require, the following Batch classes are available,

GL Batch - a GL Batch that will be removed from the unposted batches list when posted.

Standing - when a Standing journal batch is posted, an identical unposted (Standing journal) batch is created for the next period. This is useful if the same amounts need to be posted to accounts each month, for example, monthly salaries.

Reversing - enter a batch in one period and reverse it in the following accounting period without the need to re-key the batch, for example, reversing journals are commonly used for Accruals, where you take account now for something that will (or you expect will) happen in a future period. The common example is accruing for expenses you know you have incurred but have not received an Invoice for. When a reversing batch is posted, a Reversing Out Batch is created for the next period, with all Debits changed to Credits (and vice versa).

Template - never posted, these are used as the basis for duplicating, normally as a GL Batch.

Posting Batches to the General Ledger

Posting batches to the General Ledger is a straight forward process

You can only post batches that fall within the available period window (between first and last available period

Tasks\General Ledger\Enter Transactions

Note: It is important to take a backup of your data before posting batches to the General Ledger.

In the screen in front you will see transaction batches already there if you have transferred from the various modules. These transactions will have the name of the module transferred under the details heading and have a class of module batch.

Open the transaction batch by selecting the transaction and clicking the open details button.

Check that the transactions in the batch are correct

Repeat this process for all batches if wanting to post all batches at one time

If wanting to post all transactions relating to the period, select the post all batches button (Post all up to current period Alt+A)

If wanting to post batches individually select the batch you wish to post and click the post individual batch button (Post selected Alt+T)

Once you have chosen to post the batch transactions will be posted to the General Ledger accounts.

Entering a GST Journal (CB – Cashbook Journal Method)

If a transaction has been entered with the wrong GST code and GST has been calculated incorrectly then a GST adjustment is required. This is best done via the Cashbook as a general ledger journal to GST will not be brought through on the GST return.

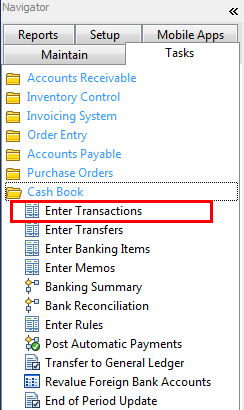

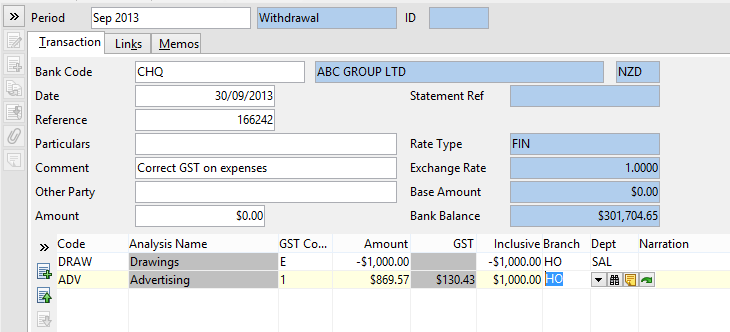

Go to Tasks\Cash Book\Enter Transactions\Withdrawal

Enter the correct Dates and a comment to explain adjustment

Ensure the Amount is $0.00

Enter the Expense code and a negative amount for the expense code that was entered incorrectly

Enter the correct Expense code and a positive amount ensuring that the GST will now be correct.

This adjustment will flow through to your GST return as a correction.

Entering a GST Journal (GST transaction Method)

These are transactions that affect GST and transfer to the General Ledger but have no financial effect on sub ledgers. Please confirmed by accountants.

Tasks\Goods and Services Tax\Enter Transactions

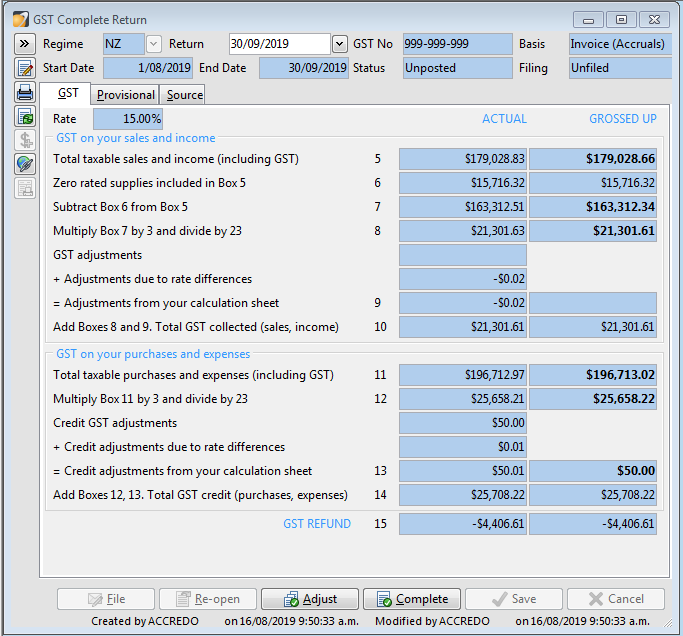

Sales Adjustment - increases the GST liability (for example, private use of business assets) and reports the GST Adjustment in Box 9, and the GST Amount in Box 10 on the return form.

Sales GST - directly adjusts the Total GST Collected figure in Box 10 on the return form. Does not appear as an adjustment.

Sales Total + GST - adjusts the Total GST Collected figure in Box 10 on the return form and is grossed up at the default GST rate into the Total taxable sales and income in Box 5 on the return form. Does not appear as an adjustment. These may be generated by the system if required for Settlement Discount adjustments.

Purchases Adjustment - decreases the GST liability and reports as a Credit GST Adjustment in Box 13, and the GST Amount in Box 14 on the return form.

Purchases GST - directly adjusts the Total GST Credit figure in Box 14 on the return form. Does not appear as an adjustment.

Purchases Total + GST - adjusts the Total GST Credit figure in Box 14 on the return form and is grossed up at the default GST rate into the Total taxable purchases and expenses in Box 11 on the return form. Does not appear as an adjustment. These may be generated by the system if required for Settlement Discount adjustments.