General Ledger Reporting

Standard General Ledger Reports

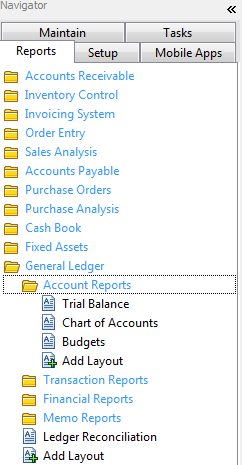

Accredo has some standard General Ledger reports, these reports are more for looking at GL transactions and GL Accounts. Not really used for financial reporting but more for analysis of the general ledger. The standard Trial balance can be found under Reports > General Ledger > Account Reports > Trial Balance. Profit and loss and the balance sheet are done using the General Ledger Report designer. During your Accredo Setup we would create a basic P&L and Balance Sheet for you to get you started.

General Ledger Report Designer(using report Wizard)

The General Ledger Report designer allows us to create standard financial reports quick and easily. It also gives us the flexibility to create custom unique financial reports. However this does require in-depth knowledge of the designer and would be something that Zeal Systems would do for you.

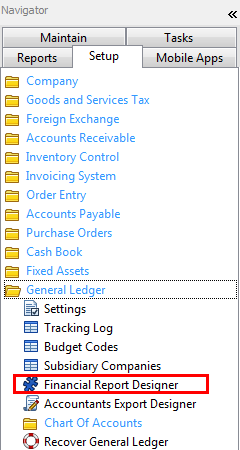

To get to the designer go to Setup > General Ledger > Financial Report Designer.

This is where we can start creating our report. You won’t need to worry too much about the current screen as we use it for fine tuning the report and doing custom work. What you want to do is click on the “Generate New report using the Wizard” button. (Shown below)

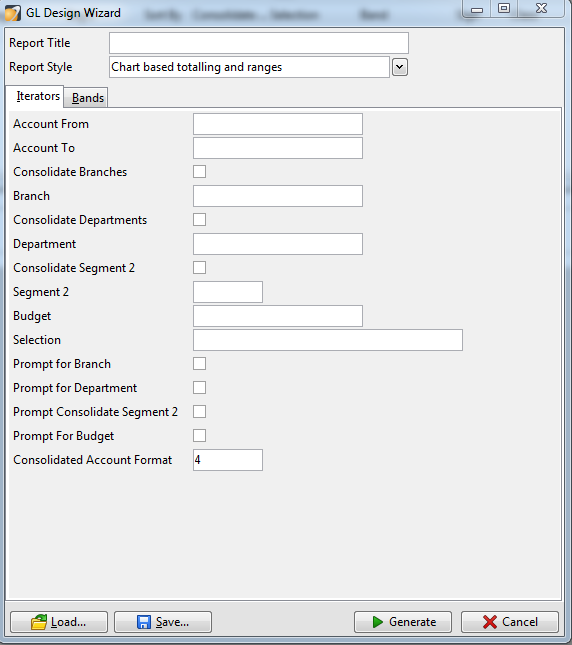

Iterators

The wizard makes creating a financial report very quick and easy. First step is to select the Account range you want to report on. If you leave it blank it will create a report for all general ledger accounts. Next we have a couple off settings and defaults we can specify for the report. Such as if we want to be prompted for a branch or department what budget we want to use and whether or not we want consolidate by segment 2. Segment 2 in Accredo is the last 3 digits of a GL account code, and consolidating segment 2 means any accounts that have the same first 4 digits it will consolidate together as 1 line on the financial reports. This is very useful if you want to have summary and detailed financial report. Segment 2 does require the chart to be setup correctly to support segment 2 consolidation.

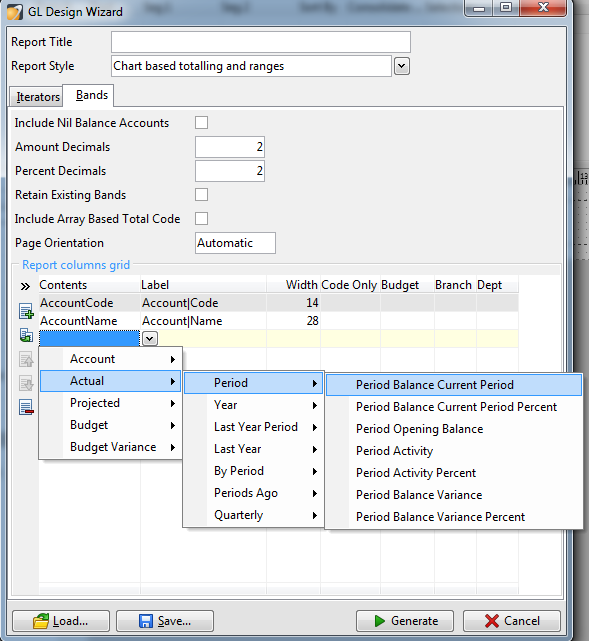

Bands

The Bands tab is where we select what columns we want on the report. We normally start off by selecting the Account code and the Account Name then added in some actuals or budgets. You also have a couple of formatting options for decimal places and page orientation.

To add in columns you use a drop down selection tool. So for the current period balance would Select Actual > Period > Period Balance Current Period and that would add in a Period balance column. We can then specify a specific branch/department/budget on the right hand side. This is useful if you wanting to compare branches to each other as separate columns. There are a lot of columns to choose from, if you can find what you are looking for get in touch and we can assist.

Once you are happy with what you have so far click on “Generate” down the bottom and the wizard will build your report. From here you can see what the report will look like by clicking on the Green Play button at the top.

If you need to make changes to the report simply click on the Wizard button again and change the settings that are required, once finished click on Generate, it will update the report with all the changes you have made. When you are ready to save the report go File > Save as and give it a name. You can now run your report by going Reports > General Ledger > Financial Reports > Financial Reports and select your report.

Reconciling to the General Ledger

As part of keeping your system in good health you should regularly check to ensure the sub modules (Cash Book, Accounts Receivable etc) reconcile to the general ledger. Variations between the two mean you could be over/under stating the performance of the business.

How to reconcile to the GL

Before you do any GL reconciliation you need to make sure all the data from the sub modules has been transfer over the GL. This is done by going to Tasks > General Ledger > Transfer from Sub modules. Post all the batches that are created. Also you should check that there are no unposted batches. You will get a warning if there is anything missing.

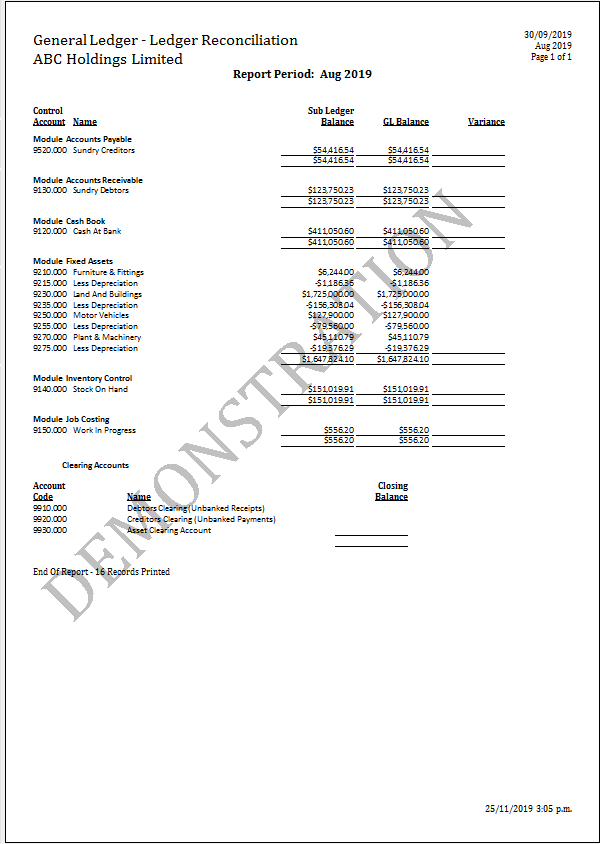

There are a few reports that you can use to reconcile to general ledger. The easiest report is to use the general ledger reconciliation report. This report can be found under Reports > General Ledger > Ledger Reconciliation.

The Report identifies where the modules does not reconcile to the general ledger. If all the data entry has been processed correctly and everything has been transferred to the GL then you shouldn’t have any variance.

Things that can cause a variance are;

Unposted GL batches

Untransferred data from the sub modules

GL batches which are coded directly to the GL Account

Transactions coded to their own or other control GL codes

GL batches which are coded directly to the GL account cause a variance. This is because the sub module does not see this transaction. It is very common for the Accountant to give you an adjustment journals to process at the end of the year for some of the control accounts, I.e. Accounts Payable. If the adjustment is not going to be reversed out in the following month then you need to check why it is being adjusted. If bad debts or stock write offs are needing to be done they need to go through their respective module, otherwise you are creating variances in the system.

Transactions coded to their own GL control account will also cause a variance. For example if you had a cash book withdraw transaction and you coded the transaction to the same GL account code as the bank account (Cash on Hand 9120.000 in this case). The Cash book module sees a withdraw coded to 9120.000 and decreases its balance by the amount say $500. The General ledger sees the Cr withdraw from the bank account, but it also sees the Dr side of the transaction and it also goes to 9120.000. So on our GL we have a net movement of $0 but on the cash book we only see -$500 as it thinks it is on an expense code.