End of Month Process

Introduction

This is intended as a comprehensive document to assist with the month end process in Accredo. This is not intended to train on how to use each module, but rather what checks should be done at the end of each month. It is assumed that the reader is already familiar with Accredo or has access to the other Zeal Training documents.

A full end of month process is not strictly required in Accredo but following one can alert you to any entry errors before they become a serious issue. It is probably the most effective way to check that staff are using Accredo correctly.

General Process

The easiest way to complete End of Month is to step through a checking and completion process for each module. Generally, this follows the following framework:

Module Completion Framework

Check all the documents for the month are completed.

Check all the transactions have been allocated correctly.

Print off and verify reports. Sign off by appropriate person.

Transfer to General Ledger (GL), Post Batches.

Check Module and GL balances Match.

Roll Module – End of period Update.

Feedback is Important

If you have not followed a full end of month process before you may uncover entry errors that will significantly slow you down as corrections are required. If entry staff are given feedback and additional training, errors and corrections should reduce significantly.

Timeline

Once you’ve worked the kinks out of your processing End of month should take between an hour to half a day depending on your size and complexity.

Module Order

We are often asked what order the modules should be completed in. The truth is there really is no correct order as each module can be completed individually. However, depending on your business or industry practices you may find that you can complete some modules earlier than others. You’ll tend to fall into a pattern based on how you operate.

A Suggested Common Order

Cashbook (CB) – as soon as bank statements are available.

Accounts Receivable (AR IN OE) – once the invoices are finalised.

Accounts Payable (AP PO) – as soon as all creditor invoices are received.

Fixed Assets (FA)

Inventory Control (IC)

Job Costing (JC)

Goods and Services Tax (GST)

General Ledger (GL)

Quick Tips

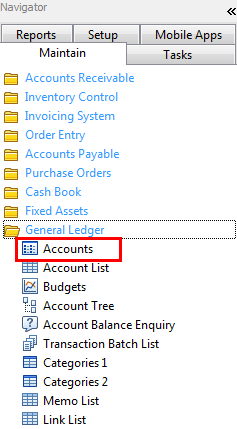

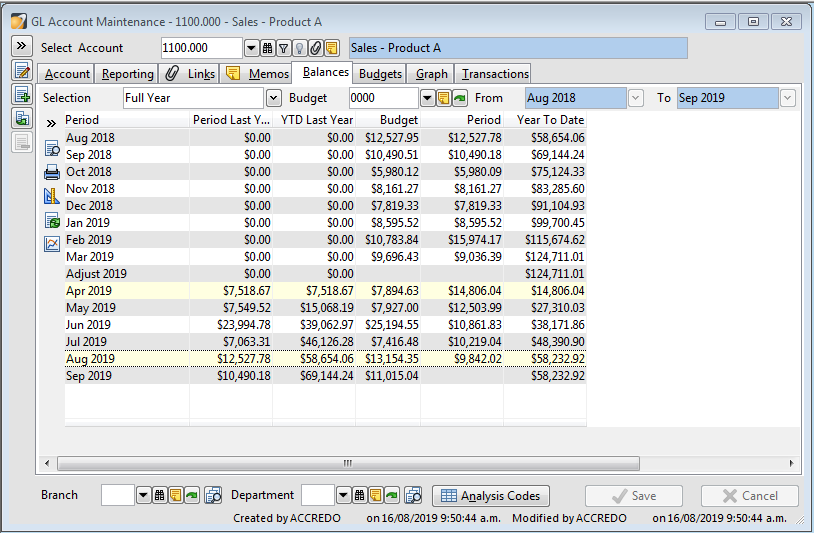

How Do I Check a Month End General Ledger Balance?

Maintain / General Ledger / Accounts

Select the account you want to check & go to the balance tab.

I can’t find report “xyz”!

If you are missing one of the reports mentioned – please do give us a call and we will install it for you.

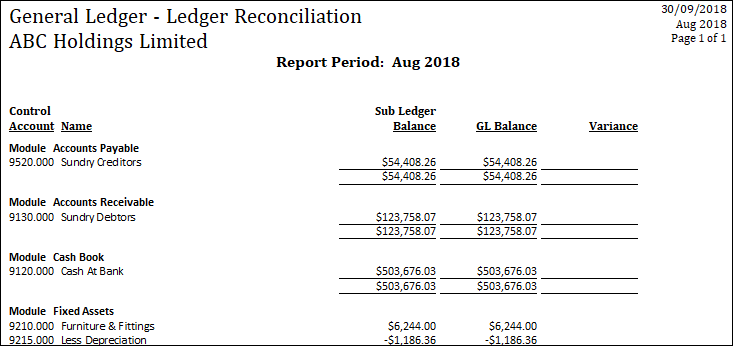

Quickly Checking Module Balance to GL

A Report that confirms your GL and Modules are in sync

Reports > General Ledger > Ledger Reconciliation

Transfer from All Modules in one go.

Tasks > General Ledger > Transfer From Sub Ledgers

Specific Module Instructions

Cashbook (CB)

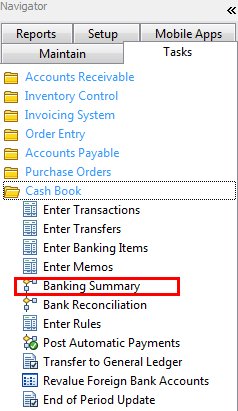

Have all bank summaries been completed?

Tasks / Cashbook / Bank Summaries

View all bank accounts (Ctrl +A).

The only summaries showing under “unposted” should be takings prepared for banking but not physically deposited at the bank yet. These will remain in the Debtors Clearing Account.

Ideally there should be nothing here.

Are there any banking item transactions not on a summary?

Create a new bank summary, select all items. There should probably not be any items in the unbanked area.

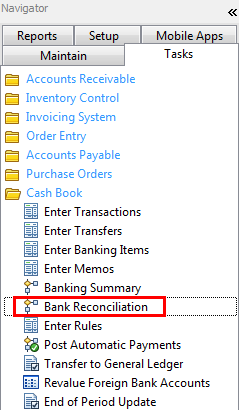

Reconcile the bank statements

Tasks / Cashbook / Bank Reconciliation

For each bank account complete a bank reconciliation to the month end date. It is important that you do check and use the actual statement balances.

Check unreconciled entries. The only unreconciled items should be:

Transactions that occurred on the last few days of the month but that don’t show on the bank statements yet.

Un-deposited cheques.

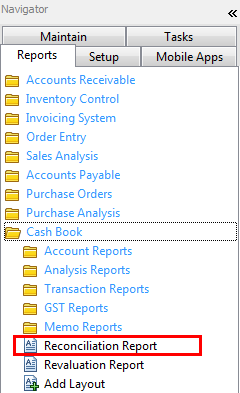

Print out the reconciliation for each bank account

You can get them all on one report under Reports / Cashbook / Reconciliation Report.

These should be signed off by the appropriate person.

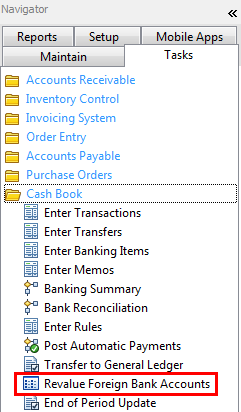

Revalue any Foreign Exchange Balances

Tasks / Cashbook / Revalue Foreign Bank Accounts

Transfer, Check GL balances & Roll

Check which bank accounts go to which GL codes (Maintain / Cashbook / Bank Account List).

Check the month end balance of each account matches the corresponding cashbook balance on the reconciliation report.

Transfer to General Ledger, Post the CB batches generated.

End of Period Update. Tasks / Cashbook / End of Period Update.

Accounts Receivable (AR + IN + OE)

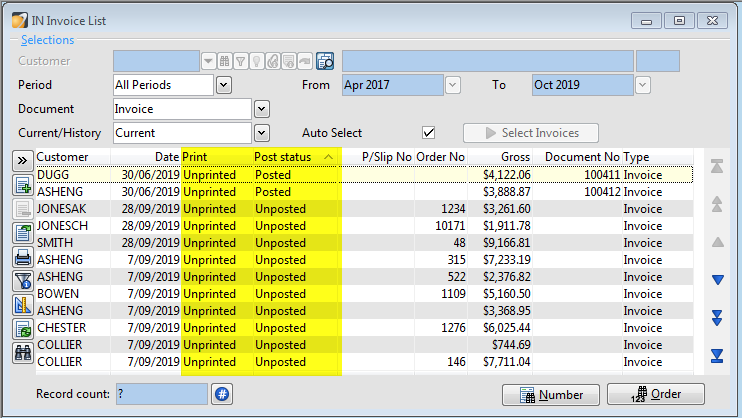

Have all invoices been printed and posted?

Maintain / Invoicing System / Invoice List

Select all Customers (Ctrl+A).

The invoices showing here are invoices that the system deems – incomplete (Either Unposted or Unprinted). Check that there are no unposted invoices here that should have been posted.

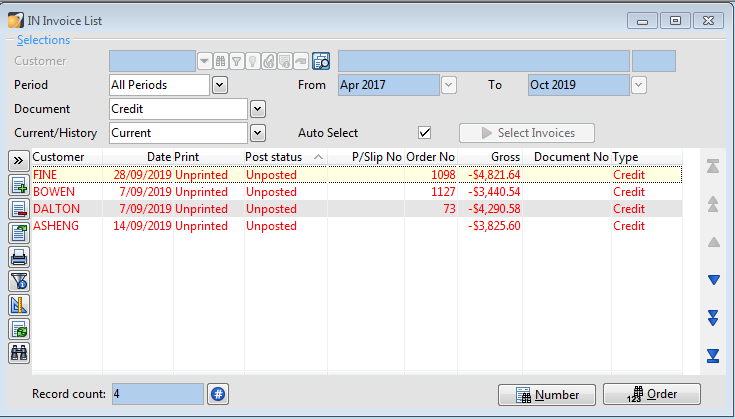

Repeat for credits.

Have all transactions been allocated correctly?

Reports / Accounts Receivable / Transaction Reports / Unallocated Reports.

Generally, run this with the receipts and credits tick on.

Only transactions relating to customers prepaying and credits not applied should show here.

If you have not performed this step before you may want to run this report with the tick off to identify any invoice-contra transactions that may have missed their allocation.

Allocate any transactions that should not be on the list.

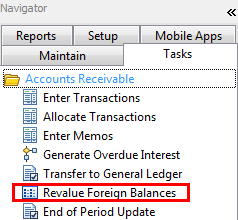

Revalue Foreign Balances

Tasks / Accounts Receivable / Revalue Foreign Balances.

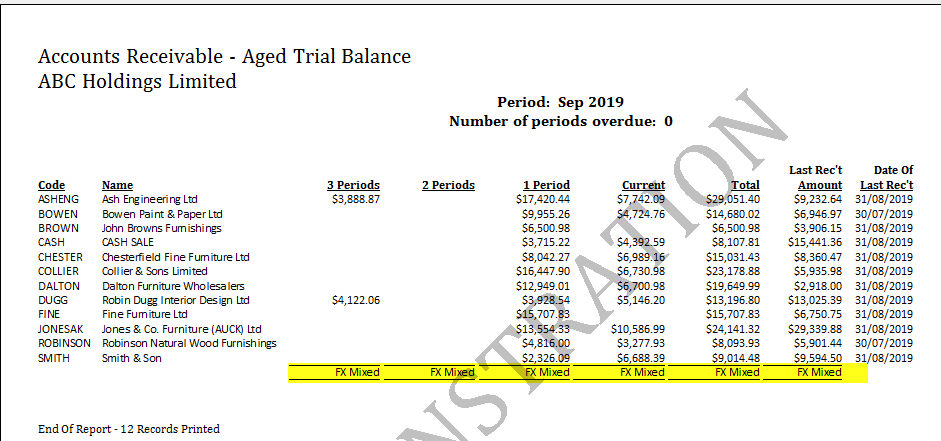

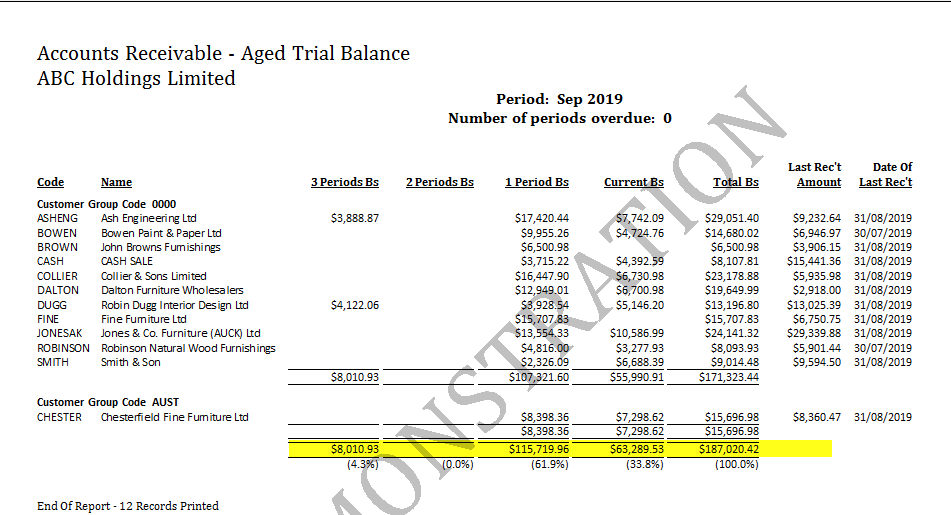

Does the Aged Trial balance (ATB) make sense?

Reports / Accounts Receivable / Customer Reports / Aged Trial Balance.

Check that this report makes sense – in particular check:

Are any final balances zero? (missed allocation)

Are any final balances very minor? (rounding – consider write off)

Are any balances negative (is there actually a credit?)

You may need to add a column for a total in your base currency if your totals read “FX Mixed” (It is recommended that you group by Customer Groups or Currencies)

This report should be signed off by the appropriate person.

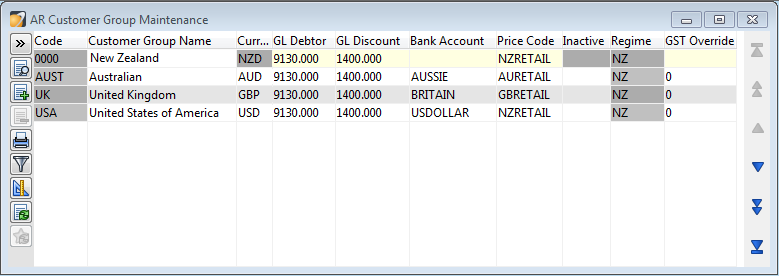

Transfer, Check GL balances & Roll

Check which Customer Groups or Currencies go to which GL codes (Maintain / Accounts Receivable / Customer Groups).

Check the month end balance of each Group or Currency matches the corresponding Group or Currency total on the ATB report.

Transfer to General Ledger, Post the AR batches generated.

End of Period Update. Tasks / Accounts Receivable / End of Period Update.

Accounts Payable (AP + PO)

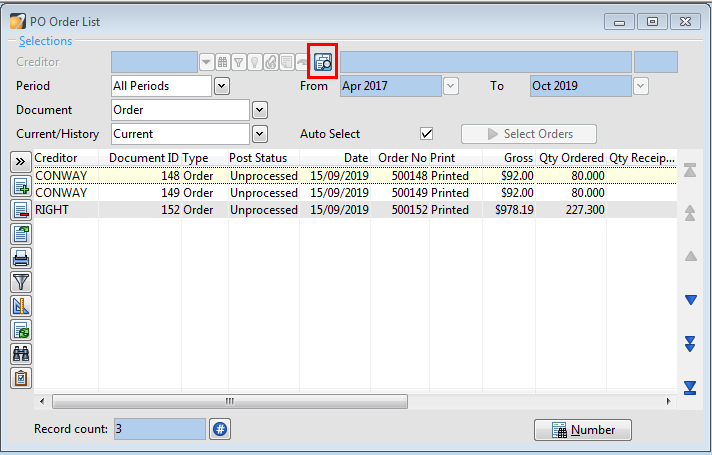

Are outstanding PO’s still current?

Maintain / Purchase Orders / Purchase Order List

Select all Creditors (Ctrl+A). These are the outstanding Purchase Orders. Check that they are still outstanding – any purchase order not required should be deleted or marked processed (any outstanding quantity is no longer required on this order).

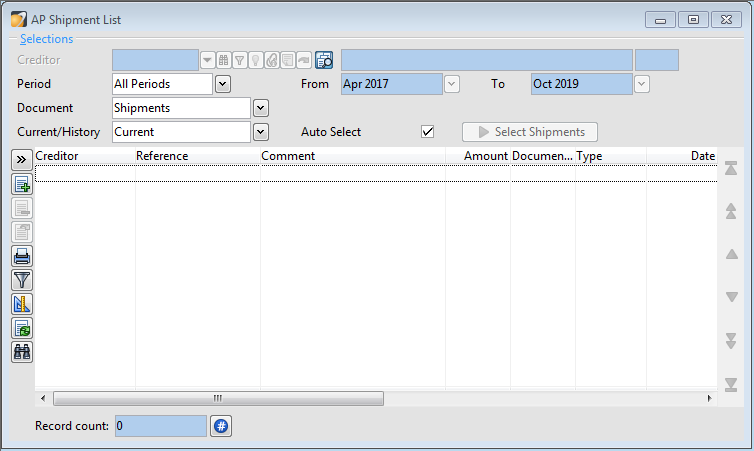

Have all Shipment invoices been posted?

Maintain / Accounts Payable / Shipment List

Select all Creditors (Ctrl+A). This shows the Shipments that are not fully processed. Ensure that all Shipments that have had an invoice arrive have been entered and posted.

Make sure you also deal with invoice only or receipt only shipment in case there will be accrual issue.

Have all transactions been allocated correctly?

Reports / Accounts Payable / Transaction Reports / Unallocated Transactions

Generally, run this with the payments and credits tick on. Only transactions relating to prepaying creditors and credits not applied should show here. If you have not performed this step before you may want to run this report with the tick off to identify any invoice-contra transactions that may have missed their allocation. Allocate any transactions that should not be on the list.

Revalue Foreign Balances

Tasks / Accounts Payable / Revalue Foreign Balances.

Does the Aged Trial balance (ATB) make sense?

Check that this report makes sense – in particular check

Are any final balances zero? (missed allocation)

Are any final balances very minor? (rounding – check statements for write off)

Are any balances negative (is there actually a credit?)

You may need to add a column for a total in your base currency if your totals read “FX Mixed” (It is recommended that you group by Creditor Groups or Currencies)

This report should be signed off by the appropriate person.

Transfer, Check GL balances & Roll

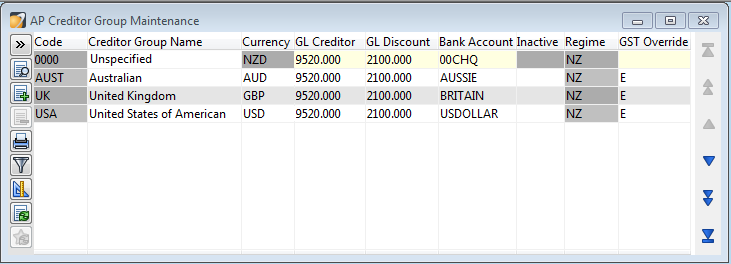

Check which Creditor Groups or Currencies go to which GL codes (Maintain / Accounts Payable / Creditor Groups).

Check the month end balance of each Group or Currency matches the corresponding Group or Currency total on the ATB report.

Transfer to General Ledger, Post the AP batches generated.

End of Period Update. Tasks / Accounts Payable / End of Period Update.

Fixed Assets (FA)

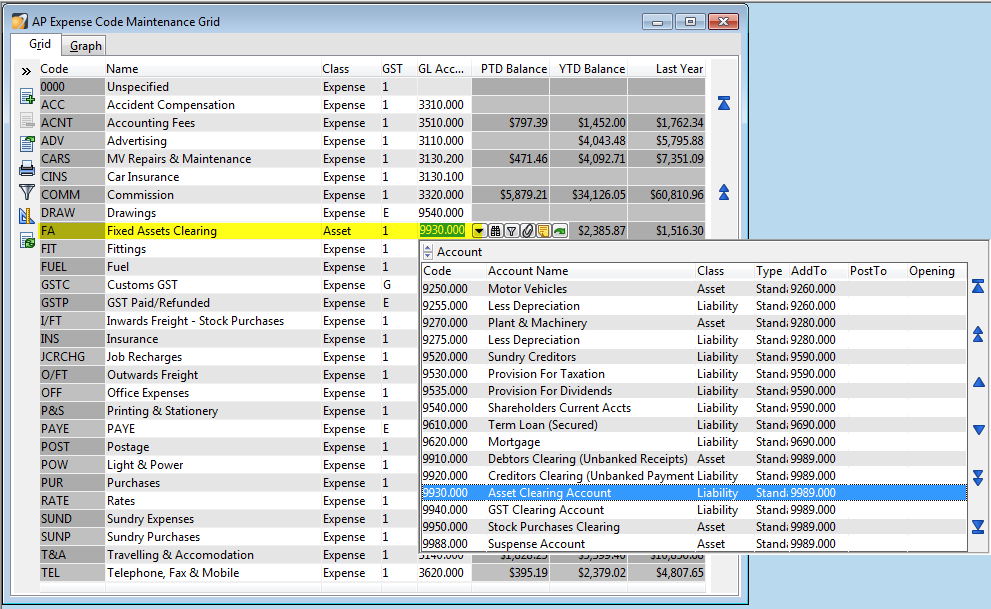

Have all FA transactions been coded correctly?

All your asset transactions should be coded to an asset suspense account for the CB, AP and AR modules. Not directly to the Asset GL accounts.

Check this under the PTD column in:Maintain / Accounts Receivable / Sales Groups Grid

Maintain / Accounts Payable / Expense Codes Grid

Maintain / Cashbook / Analysis Codes Grid

Have the transactions been processed in FA?

Check the balance of Asset clearing account – it should be zero if all the required asset transactions in the FA module have been correctly entered.

Preview & Generate Depreciation.

Tasks / Fixed Assets / Preview (Generate) Depreciation

Generally, you will want to preview the depreciation for the month first to identify any entry errors, and then generate the depreciation for the month once the preview is correct.

Print out the Depreciation Schedule for the Month

Reports / Fixed Assets / Depreciation Schedule.

This report should be signed off by the appropriate person.

Transfer, Check GL balances & Roll

Check which Asset Groups go to which GL codes (Maintain / Fixed Assets / Asset Groups).

Check the month end balance of each Group matches the corresponding Group total on the depreciation schedule.

Transfer to General Ledger, Post the FA batches generated.

End of Period Update. Tasks / Fixed Assets / End of Period Update.

Inventory Control (IC)

Have all Inventory movement documents been posted?

Go back to the Shipments list and ensure that all shipments that have had goods arrive have had their receipts posted.

Go back to the Invoices List and check that all goods that have left the premises have had the invoices posted.

Stocktakes and Adjustments

Tasks\Inventory Control\Stocktake Processing\Generate Stocktake. If a full or partial stocktake or any other stock adjustment is required this should be processed now.

Revalue

Tasks / Inventory Control / Revalue Stock on Hand.

Print Stock Balances and Valuations

Reports / Inventory Control / Product Reports / Period Sales and Valuation. It is suggested that you group this report by Stock Groups.

Check for numbers that don’t make sense such as negative stock.

This report should be signed off by the appropriate person.

Transfer, Check GL balances & Roll

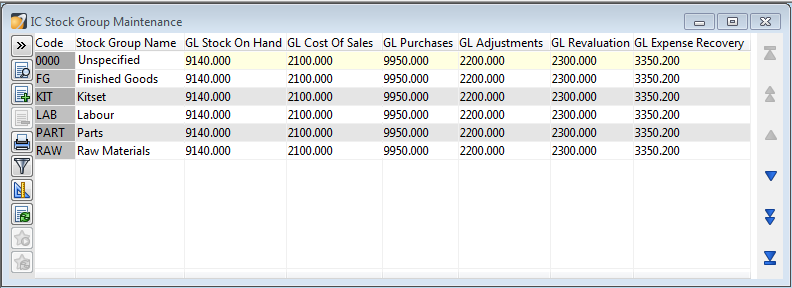

Check which Stock Groups go to which GL codes (Maintain / Inventory Control / Stock Groups).

Check the month end balance of each Group matches the corresponding Group total on the Valuation Report.

Transfer to General Ledger, Post the IC batches generated.

Check if Stock on Hand GL codes (Balance Sheet) and Closing Balances (Profit and Loss) are the same.(Periodic method)

End of Period Update. Tasks / Inventory Control / End of Period Update.

Job Costing (JC)

Job Costing varies greatly from site to site. We will work with you on this.

A general process for Job Costing would look something like this:

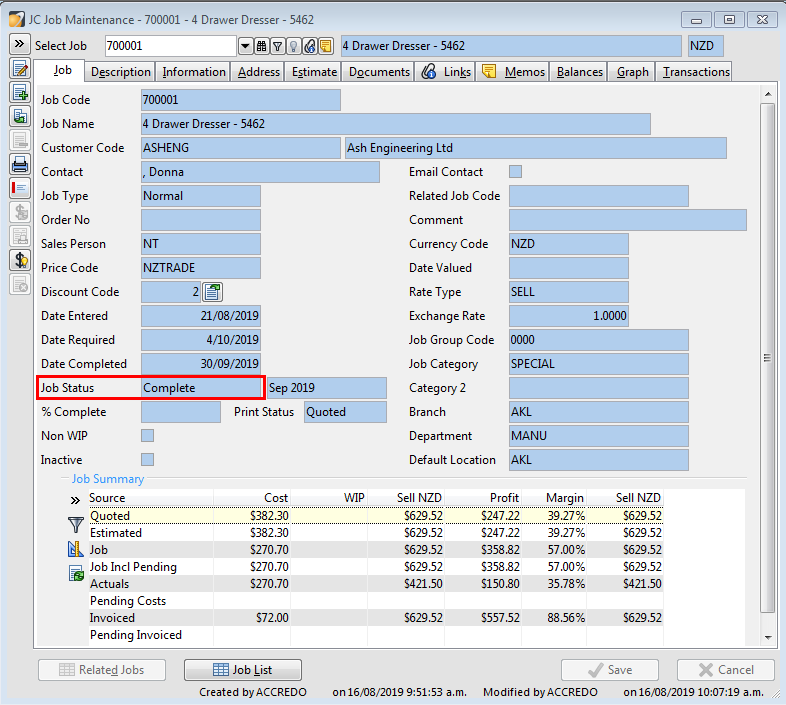

Complete Jobs

Check the active jobs list. Maintain / Job Costing / Job List.

Select all Customers (Ctrl+A).

Ensure that active jobs are still in progress.

Complete any jobs that are done and invoiced.

Calculate Work in Progress (WIP)

Calculate and make any adjustments required to WIP.

Verify WIP with a WIP report (grouped by Job Group).

This report should be signed off by the appropriate person.

Transfer, Check GL balances & Roll

Check which Job Groups go to which GL codes (Maintain / Job Costing / Job Groups).

Check the month end balance of each Group matches the corresponding Group total on the WIP Report.

Transfer to General Ledger, Post the JC batches generated.

End of Period Update. Tasks / Job Costing / End of Period Update.

Goods & Services Tax (GST)

This will only be done for months that you have a GST return due.

Reconcile the GST Balance

There are separate notes for this as it requires a bit of work – you may wish to leave this to be done by your accountant annually.

This report should be signed off by the appropriate person.

Prepare the Return

Tasks / Goods & Services Tax / Complete Return

Check the module GST reports for unusual transactions

Make any GST adjustment transactions required.

Transfer, Check GL balances & Roll

Transfer to General Ledger, Post any GST batches generated.

If it is a GST month - Accept Return and lock down the system.

If you prepared a reconciliation you should be able to verify your accepted return to your GST GL balances.

General Ledger (GL)

Standing Journals

Process any journals that you repeat month to month.

Check all GL batches have been posted

Tasks / General Ledger / Enter Transactions. There generally shouldn’t be any unposted journals here.

Check Balance Sheet Integrity

Tasks\General ledger\Validate Ledger. If any codes have been added during the month check that the balance sheet still balances.

Your Ledger Variance code (at the end of the ledger) should have a balance of zero.

Print Financial Reports

Print your standard financial or management reports.

Roll

Tasks / General Ledger / End of Period Update.