Fixed Assets General

After completing this lesson, you will be able to:

• Set up a new Asset

• Add the new asset via Manual method, Cashbook or Accounts Payable

• Transfer to General Ledger

• Preview and generate depreciation

Fixed Assets

The Process – Brief Overview

Code the "Purchase/Sale" Transaction to Asset Clearing (either CB, AP, AR)

1. Setup the Fixed Asset (if a purchase) Maintain FA – Note: FA can be added directly from CB & AP screen (see additional notes on set up requirements)

2. Create the transaction in FA, Tasks / FA / Enter Transaction. Show a purchase, Disposal for $$$ and for 0, and a partial disposal (part sale)

3. EOM

1. Check Asset Clearing Empty

2. Preview Depreciation

3. Generate Depreciation

Set Up New Fixed Assets

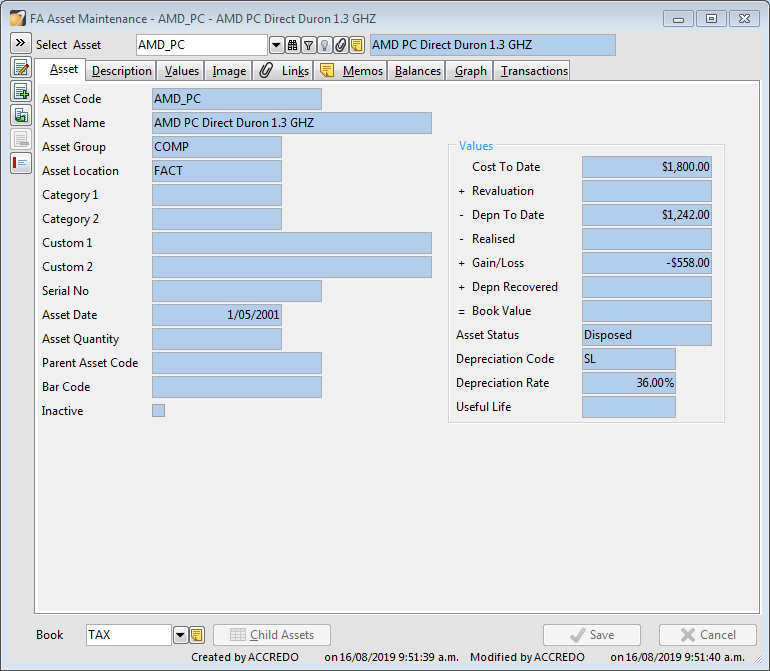

Create asset master file in the Fixed assets module

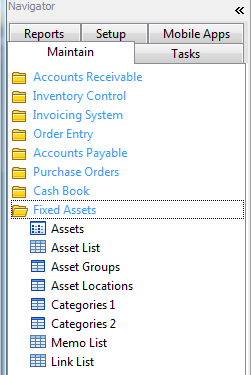

Maintain – Fixed Assets – Assets

Enter an Asset Code, Asset Name, Asset Group (if applicable), Asset Location (if applicable), Asset Date, Asset Quantity, Depreciation Code (Straight Line/Diminishing Value) and Depreciation Rate. Add any other relevant information if required.

Note: If there are multiple books (such as Tax book / management book) the values tab must be used to specify the differing rates for each book

Create the Addition in Fixed Assets

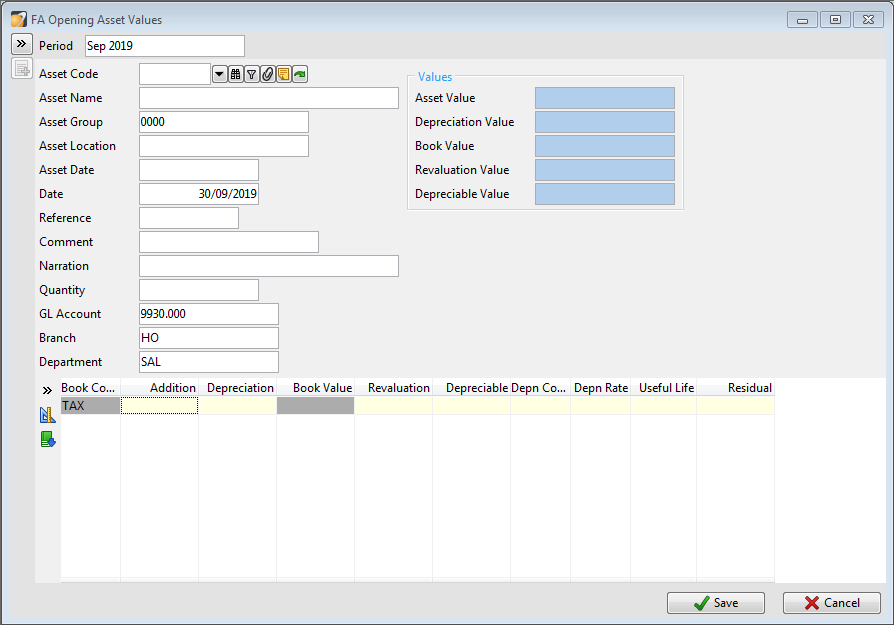

· Create an Addition for a new purchase or a Disposal if selling an asset.

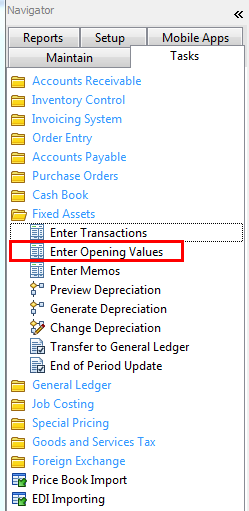

· Tasks – Fixed Assets – Enter Opening Values

· Enter the details

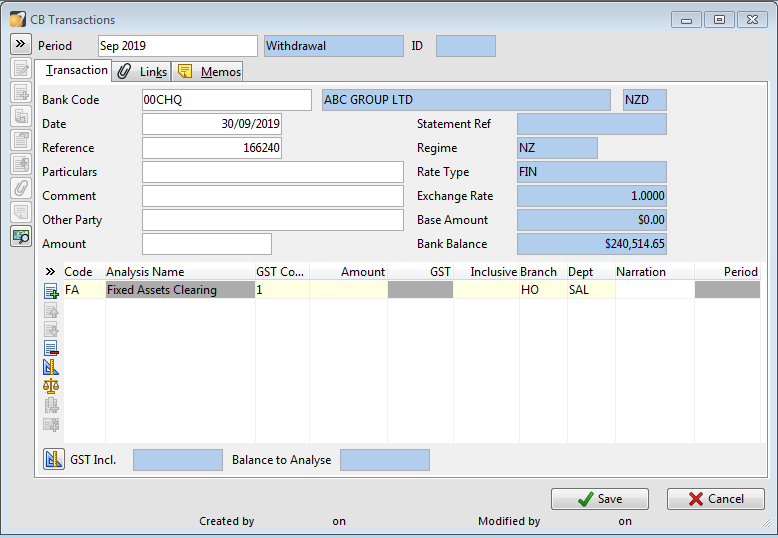

Cashbook Purchase

First of all, set up FA Clearing Code in Analysis Code in Cash Book. (Maintain\Cash Book\Analysis Codes Grid) Point FA to the Asset clearing account in GL chart.

In Task\Cash Book\Enter Transactions, Enter Dates, Amounts, Particulars and Comments. Code to the FA Clearing Account and Save.

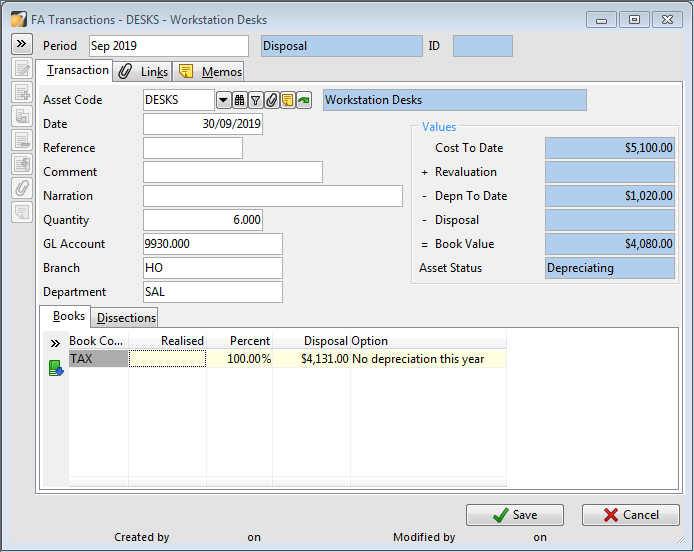

Disposals

Tasks – Enter Transactions – Disposals

Enter the Asset Code, Comment, Narration (if required), Quantity, and the Realised amount of the sale e.g. the GST exclusive amount received from the sale of the asset. Realised amount = $0 when writing off an asset.

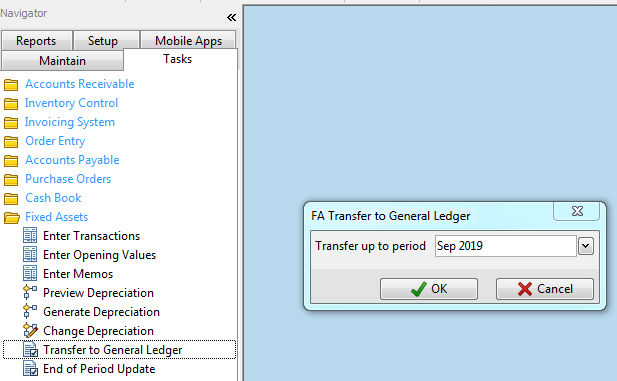

Transfer to General Ledger

Once you have performed a transfer to General ledger for FA and any other modules where transactions may have been coded to Asset Clearing account, e.g. CB, AP, the Asset clearing general ledger code should have a nil balance.

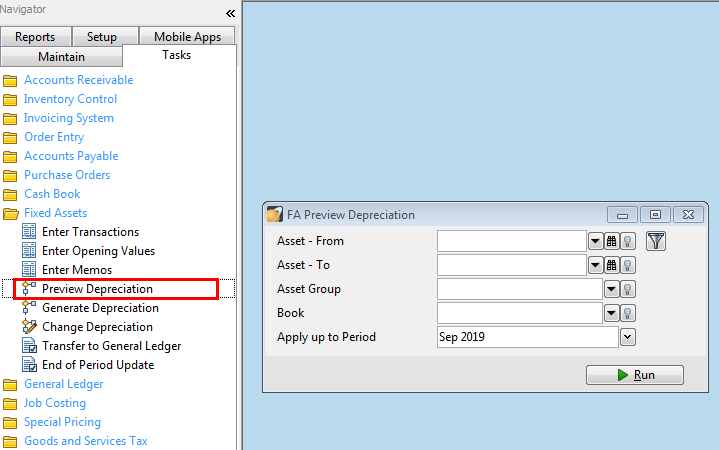

Preview Depreciation

Tasks – Fixed Assets – Preview Depreciation - Click on Run

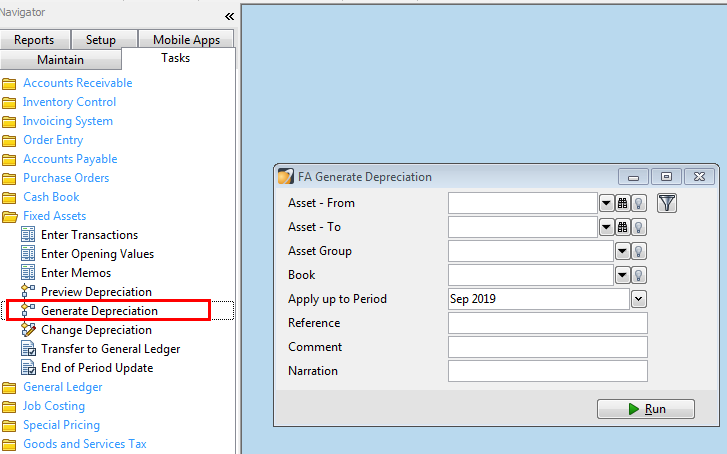

Generate Depreciation

Tasks – Fixed Assets – Generate Depreciation then Transfer to General ledger